BOOKKEEPING COURSES

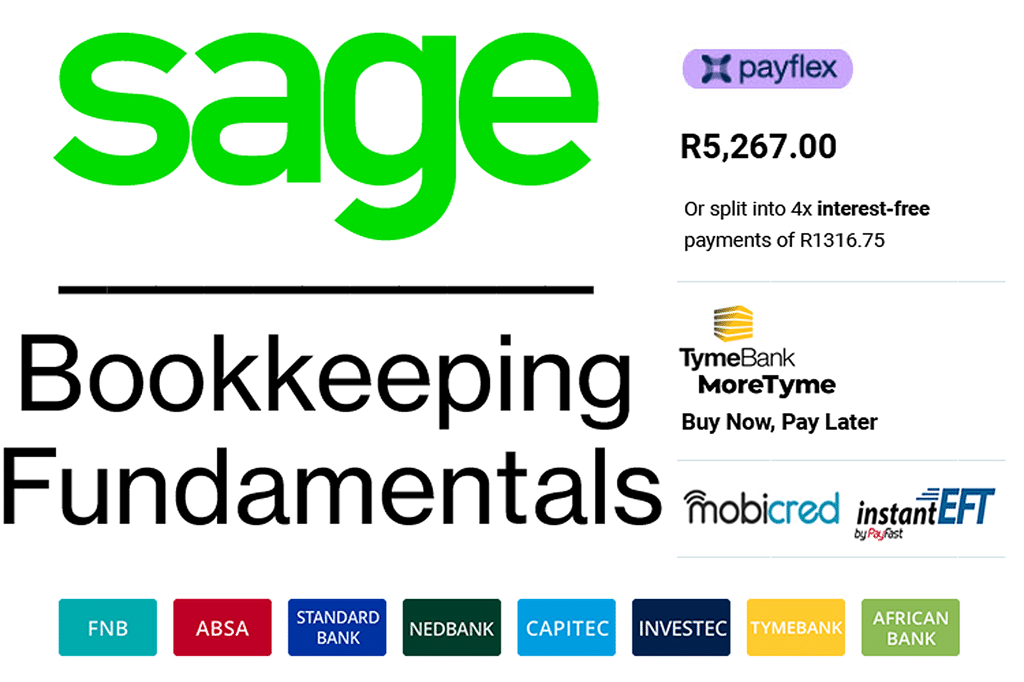

Bookkeeping Fundamentals

LESSON STRUCTURE

Lesson 01 – Bookkeeping Introduction

The Differences of companies in South Africa

What is accounting/Bookkeeping

The bookkeeping and Accounting cycle

The accounting equation

Transactions and accounts

Lesson 02 – Value added Tax (VAT)

What is VAT

The different VAT categories

Calculating VAT

VAT processing

The mark up, gross margin and VAT

Completing the VAT201 report

Lesson 03 – Inventory

Inventory Systems

Costing methods

Lesson 04 – Source Documents

Source Documents

Deposit Books / slips

Cheque counterfoils

Petty cash Vouchers

Tax Invoices

Credit Notes / Returns

Lesson 05 – Subsidiary Journals

Introduction to Subsidiary Journals

Creditors and creditors allowance journals

Debtors and debtors allowance journals

Cashbook Journals

The Cashbook receipts journal

The Cashbook payments journal

Petty Cash Journals

The General Journal

Totaling your Journal

Lesson 06 – Bank Reconciliation

Introduction

The Bank Reconciliation

Lesson 07 – The General Ledger

Different sections of a general ledger

Posting to the general ledger

Closing off ledger Accounts

Lesson 08 – The Trial Balance

Introduction

Post from your general ledger to your trial balance

Lesson 09 – The Statement of Income

Posting to your statement of Income

Lesson 10 – The Statement of Financial Position